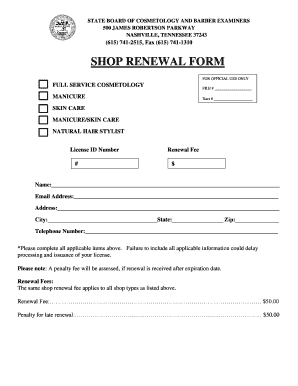

FL DR-309639 2013-2026 free printable template

Show details

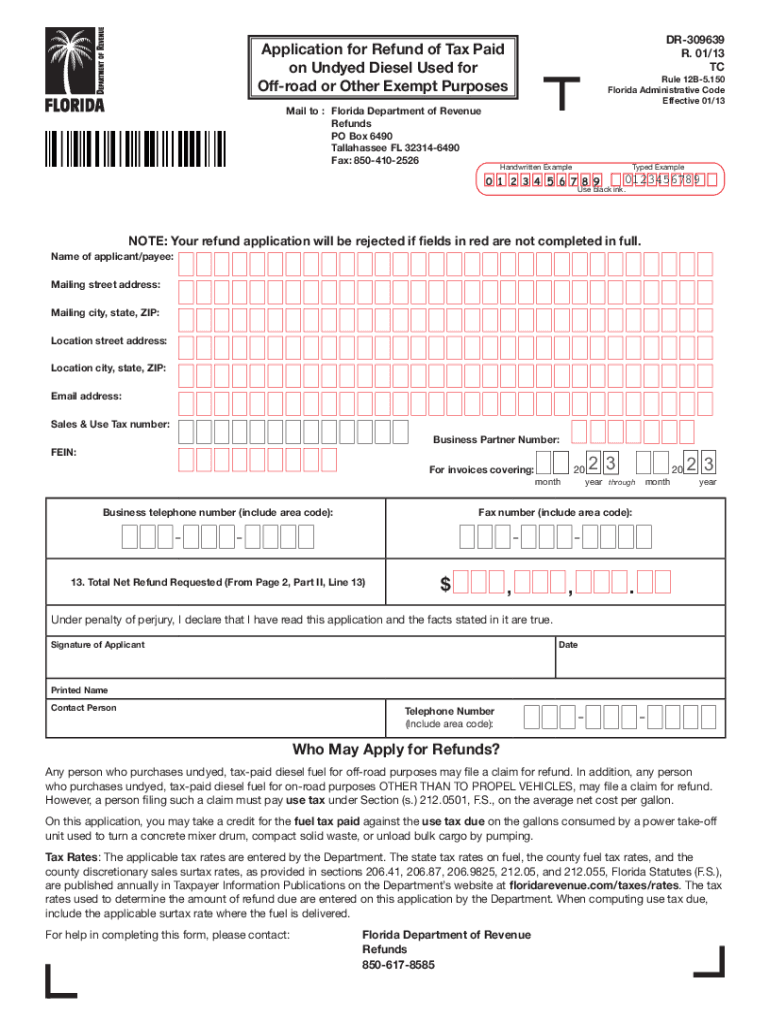

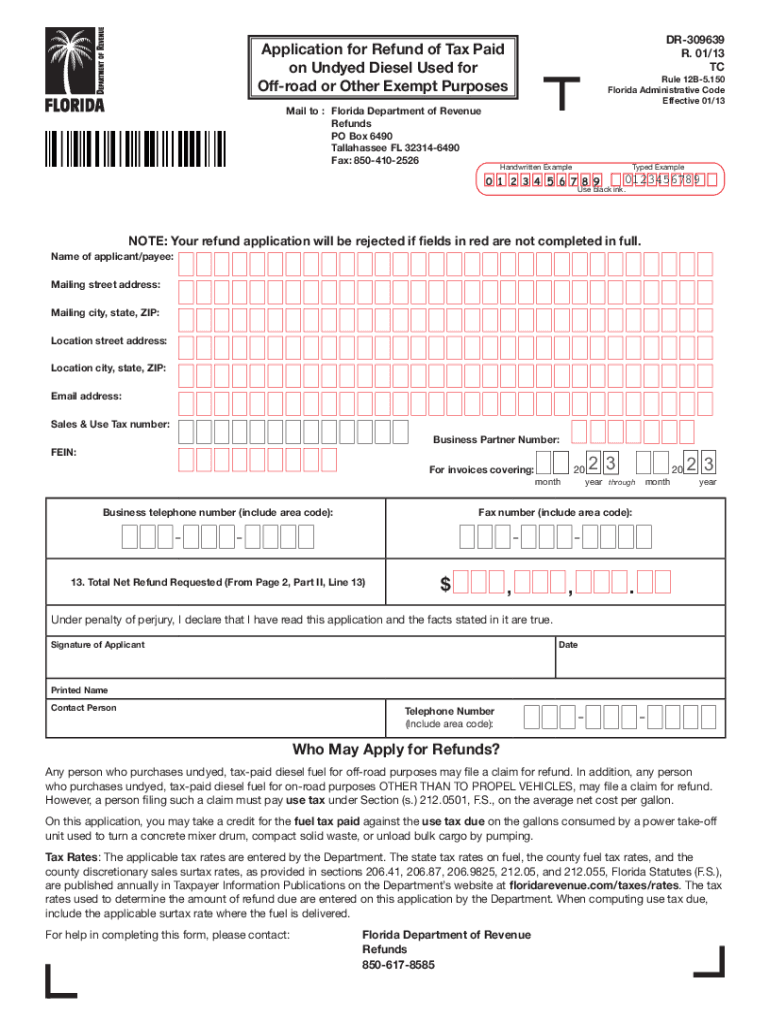

DR-309639 R. 01/13 Application for Refund of Tax Paid on Undyed Diesel Used for Off-road or Other Exempt Purposes Mail to Florida Department of Revenue Refunds PO Box 6490 Tallahassee FL 32314-6490 Fax 850-410-2526 Rule 12B-5. Page 10 When reporting less than. 50 gallons round down to the nearest whole gallon. If reporting. 50 gallons or greater round up to the nearest whole gallon. Schedule 1B Average Cost per Gallon Computation Schedule 1C Computation Schedule of Sales Tax Due by County...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL DR-309639

Edit your FL DR-309639 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DR-309639 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing FL DR-309639 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit FL DR-309639. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out FL DR-309639

How to fill out FL DR-309639

01

Obtain the FL DR-309639 form from the official website or your local court.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill out your personal information at the top of the form, including your name, address, and contact details.

04

Provide details regarding the case or matter you are addressing, ensuring accuracy.

05

Review the specific sections that apply to your situation and complete them diligently.

06

Sign and date the form at the designated section.

07

Make copies of the completed form for your records and for submission.

08

Submit the form to the appropriate court or agency as instructed.

Who needs FL DR-309639?

01

Individuals involved in legal proceedings that require disclosure of information related to family law.

02

Parents seeking modifications or establishing child support orders.

03

Parties in divorce proceedings needing to report financial situations or other relevant details.

Fill

form

: Try Risk Free

People Also Ask about

What number do I fax my forms to for the IRS?

Fax: 855-215-1627 (within the U.S.)

How do I fax a form?

To send a fax with your fax machine: Place the document you want to send in the document feeder. Enter the fax number you want to send to, including and extensions to dial externally, and any international dialing codes. Press Send or Go (depending on your fax machine model)

Can form 3115 be faxed?

Fax Form 3115 for Automatic Change COVID-19 Response: We are now accepting the signed copy of Form 3115 by fax at 844-249-8134. This applies only if you file under automatic change procedures.

What is the fax number to send documents to the IRS?

Where to fax Form SS-4: Fax NumberArea855-641-6935One of the 50 states or the District of Columbia855-215-1627 (within the US) 304-707-9471 (outside the US)If you have no legal residence, principal office, or principal agency in any state or the District of Columbia (international/US possessions) Feb 22, 2023

Is it better to fax or mail form to the IRS?

Faxing your 1040 tax form to the IRS would make things much quicker than snail mail. But unfortunately, there's no fax number for the IRS where you can send the 1040 form. You can use the 1040 form to file an income tax return, which qualifies as actual tax documents. And again, you can't fax tax returns to the IRS.

How do I fax form 3115?

COVID-19 Response: We are now accepting the signed copy of Form 3115 by fax at 844-249-8134.

How do I send form 3115?

When and where to file. There are two methods of requesting change with a Form 3115. You can file in duplicate by attaching the original form to your federal income tax return. You also need to file a copy of the form with the IRS (Internal Revenue Service) National Office after the first day of the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send FL DR-309639 for eSignature?

When you're ready to share your FL DR-309639, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I execute FL DR-309639 online?

pdfFiller makes it easy to finish and sign FL DR-309639 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out FL DR-309639 using my mobile device?

Use the pdfFiller mobile app to fill out and sign FL DR-309639. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is FL DR-309639?

FL DR-309639 is a form used in the state of Florida for reporting financial information related to state sales tax.

Who is required to file FL DR-309639?

Businesses registered for sales tax in Florida and collecting sales tax from customers are required to file FL DR-309639.

How to fill out FL DR-309639?

To fill out FL DR-309639, follow the instructions provided on the form, including entering your business information, total sales, taxable sales, and any sales tax collected.

What is the purpose of FL DR-309639?

The purpose of FL DR-309639 is to report sales tax collected by businesses and ensure proper remittance to the state.

What information must be reported on FL DR-309639?

Information that must be reported on FL DR-309639 includes the business name, address, total sales, taxable sales, amount of sales tax collected, and any adjustments or deductions.

Fill out your FL DR-309639 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DR-309639 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.